- Hutchmed

- Shareholder Information

- | Listing FAQs for Shareholders

- On which stock exchanges is HUTCHMED quoted?

- What is HKEX?

- What is Nasdaq?

- What is AIM?

- What form does HUTCHMED's HKEX quotation take?

- What form does HUTCHMED's AIM quotation take?

- What are CREST and DIs?

- What form does the U.S. listing take?

- What is an ADS?

- What is an ADS/Ordinary Share ratio?

- What are HUTCHMED’s CUSIP and ISIN numbers?

- What does a depositary do?

- How does the purchase and sale of ordinary shares, ADSs and DIs work in practice?

- Can holders of HUTCHMED securities on HKEX, Nasdaq or AIM invest in HUTCHMED securities listed on one or both of the other stock exchanges or convert from one type of security to another?

- What is the conversion process between HKEX, Nasdaq and AIM?

- How do I contact HUTCHMED’s depositaries?

- How do I contact HUTCHMED’s share registrars?

- Are holders of ADRs/DIs entitled to vote at HUTCHMED’s annual general meeting?

- How can I keep up to date with latest developments at HUTCHMED?

- How do I obtain a copy of HUTCHMED’s annual report?

- Who is HUTCHMED's independent registered public accounting firm?

- When is HUTCHMED’s financial year end?

On which stock exchanges is HUTCHMED quoted?

HUTCHMED is listed on The Stock Exchange of Hong Kong Limited (“HKEX”) under the stock code “13” and on the Nasdaq Global Select Market (“Nasdaq”) under the ticker symbol “HCM”. It is also admitted to trading on the AIM market operated by the London Stock Exchange (“AIM”) under “HCM”.

See below “What is the conversion process between HKEX, Nasdaq and AIM?” for details of the procedure for changing shares between the three exchanges.

What is HKEX?

The Stock Exchange of Hong Kong Limited, also known as HKEX, is the Hong Kong stock exchange. Additional information is available at www.hkexnews.hk.

What is Nasdaq?

The Nasdaq Stock Market, also known as simply Nasdaq, is an American stock exchange. It is the second-largest stock exchange by market capitalization in the world, after the New York Stock Exchange. Additional information is available at www.nasdaq.com.

What is AIM?

AIM is the London Stock Exchange's international market for growth companies and it is the most successful growth market in the world. Additional information is available at www.londonstockexchange.com.

What form does HUTCHMED’s HKEX quotation take?

HUTCHMED’s ordinary shares are traded on the HKEX in the form of ordinary shares.

What form does HUTCHMED’s AIM quotation take?

HUTCHMED’s ordinary shares are traded on AIM and trades are settled electronically through the CREST system in the form of depositary interests (“DIs”). HUTCHMED’s ordinary shares traded on AIM are held by a depositary, Computershare Investor Services PLC (“Computershare”). Computershare issues DIs representing the underlying ordinary shares on a one-for-one basis and maintains a register of DI holders. The corresponding ordinary shares are held by Computershare on trust for the holders of DIs.

What are CREST and DIs?

CREST is a paperless settlement procedure enabling securities to be evidenced other than by a certificate and transferred other than by a written instrument, so that trades can settle electronically. Securities issued by non-U.K. companies, such as the ordinary shares of HUTCHMED, cannot be directly held or transferred under the CREST system, which is why DIs are required.

A DI is a facility created to enable HUTCHMED’s ordinary shares to be delivered, held and settled under the CREST system. Each DI will be treated as one ordinary share for the purposes of determining, for example, entitlement to dividends, voting rights, participation in pre-emptive follow-on offerings and returns of capital. DIs are a common feature of the AIM market and are used by many non-U.K. AIM companies.

What form does the U.S. listing take?

HUTCHMED’s ordinary shares are traded on Nasdaq in the form of American depositary shares (“ADSs”). As a result, a portion of HUTCHMED’s ordinary shares are held by its ADS depositary bank, Deutsche Bank Trust Company Americas (“Deutsche Bank”), which ordinary shares underly the ADSs held by U.S. shareholders. The ADSs are a common feature used by non-U.S. companies on the Nasdaq Stock Market.

What is an ADS?

An ADS represents ownership of shares in a non-U.S. corporation. ADSs are quoted and traded in U.S. dollars in the U.S. securities markets. ADS dividends are paid to investors in U.S. dollars. ADSs were specifically designed to facilitate the purchase, holding and sale of non-U.S. securities by U.S. investors.

What is an ADS/Ordinary Share ratio?

This ratio reflects the number of ordinary shares that correspond to one ADS. In the case of HUTCHMED, each ADR represents five ordinary shares.

What are HUTCHMED’s CUSIP and ISIN numbers?

| Ordinary Share ISIN: Ordinary Share CUSIP: |

KYG4672N1198 G4672N 119 |

| ADS ISIN: ADS CUSIP: |

US44842L1035 44842L 103 |

| DI ISIN: | KYG4672N1198 (same as the Ordinary Share) |

What does a depositary do?

A depositary is an entity which facilitates cross-border trading of an issuer’s shares. Among other things, depositaries provide ADS and DI issuance and cancellation services, and associated share transfer services such as maintaining the register of ADS or DI holders, distributing dividends to ADS and DI holders, providing annual meeting services and executing corporate actions. So, in practice, Deutsche Bank and Computershare, as the depositaries, maintain records of the holders of ADSs and DIs, respectively, and manage the flow of shares between the two separate markets, essentially converting DIs into ADSs when there is demand in the U.S., and converting ADSs back into DIs when there is demand for the DIs in the U.K. This service facilitates liquidity between the two markets with the objective that any price differential between the two markets is kept to a minimum.

How does the purchase and sale of ordinary shares, ADSs and DIs work in practice?

You can buy ordinary shares, ADSs or DIs through a broker, just as you would any other Hong Kong, U.S. or U.K. security. When you instruct your broker to buy HUTCHMED’s ordinary shares on your behalf, your broker will have the option of buying ordinary shares on HKEX, ADSs on Nasdaq or DIs on AIM. Conversely, when you wish to sell your position, your broker will either sell them on HKEX, Nasdaq or AIM. Any necessary conversion of securities would first be effected in the manner described below. In any event, this would be a seamless process for shareholders. Unless shareholders particularly wish to give specific instructions in that regard (in which case they are free to do so), they will not need to be concerned with which market their shares are purchased from or sold into. Brokers will simply buy or sell in the market where there is the most liquidity at that time.

Can holders of HUTCHMED securities on HKEX, Nasdaq or AIM invest in HUTCHMED securities listed on one or both of the other stock exchanges or convert from one type of security to another?

Yes, it is permissible for holders of ordinary shares, ADSs or DIs to purchase HUTCHMED’s other securities (for example, an ADS holder may purchase DIs and/or ordinary shares through its broker) or to convert some or all of their HUTCHMED securities from ordinary shares, DIs or ADSs into one of its other listed securities. The conversion process is described in further detail below. We would advise that shareholders seek advice from their broker and/or tax adviser.

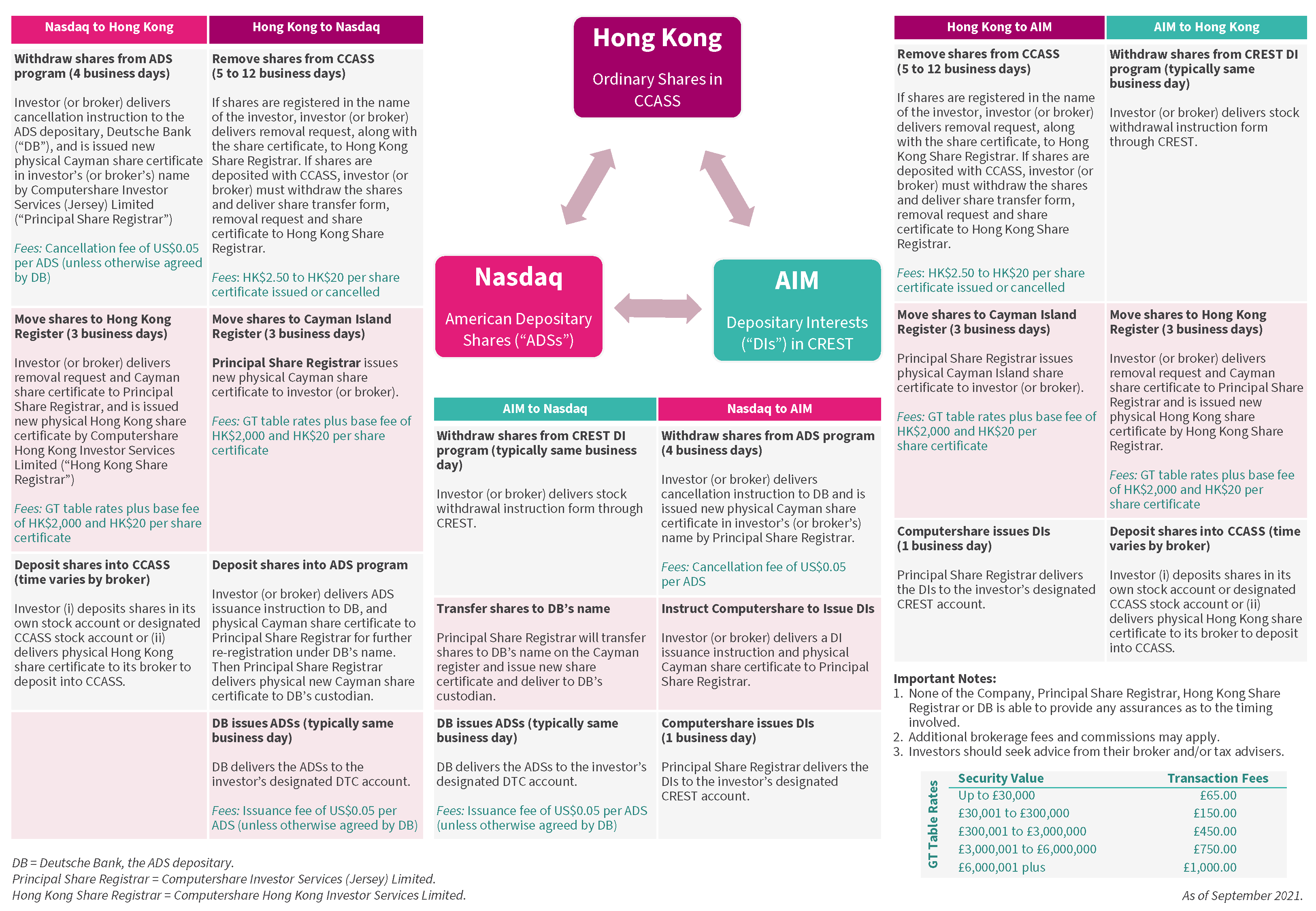

What is the conversion process between HKEX, Nasdaq and AIM?

A more detailed explanation of the steps for conversion can be found here. To enquire regarding transferring shares to be traded on AIM or HKEX, please contact the Registrar, Computershare. To enquire regarding conversion of shares into Nasdaq-traded ADSs, please contact the ADS Depositary, Deutsche Bank. Contact information is available below.

How do I contact HUTCHMED’s depositaries?

ADS Depositary Contact Information – Deutsche Bank Trust Company Americas

DR Markets Distribution

| New York: | +1 212 250 9100 |

| London: | +44 (0)20 7547 6500 |

| Hong Kong: | +852 2203 5216 |

| Email: | adr@db.com |

CREST Depositary Contact Information – Computershare Investor Services PLC

The Pavilions

Bridgwater Road

Bristol BS99 6ZY

United Kingdom

| Tel: | +44 (0)370 707 4040 |

| +44 (0)370 702 0000 |

How do I contact HUTCHMED’s share registrars?

Hong Kong Share Registrar contact information:

Computershare Hong Kong Investor Services Limited

Rooms 1712-1716, 17th Floor Hopewell Centre

183 Queen’s Road East

Wanchai, Hong Kong

| Contact form: | Computershare Online |

| Tel: | +852 2862 8555 |

Principal Share Registrar contact information:

Computershare Investor Services (Jersey) Limited

13 Castle Street

St. Helier

Jersey, JE1 1ES

Channel Islands

Tel: +44 (0)370 707 4040

Are holders of ADRs/DIs entitled to vote at HUTCHMED’s annual general meeting?

Holders of ADSs/DIs may authorize HUTCHMED’s applicable depositary, Deutsche Bank or Computershare, to act as a proxy in exercising voting rights in accordance with the ADS/DI holder's directions according to the number of ordinary shares represented by their respective ADSs/DIs.

How can I keep up to date with latest developments at HUTCHMED?

You can send an email to investor relations requesting to be notified of any new updates announced here.

How do I obtain a copy of HUTCHMED’s annual report?

HUTCHMED’s annual report, interim report and other press releases can be downloaded from HUTCHMED’s website.

Who is HUTCHMED’s independent registered public accounting firm?

PriceWaterhouseCoopers.

When is HUTCHMED’s financial year end?

HUTCHMED's financial year ends on December 31.